ad valorem tax florida statute

Authorized by Florida Statute 1961995. 1 In any administrative or judicial action.

Florida Real Estate Taxes What You Need To Know

1 Ad valorem taxes and non-ad valorem assessments shall be assessed against the lots within a platted residential subdivision and not upon the subdivision property as a whole.

. The community land trust model envisions that the. The term property tax. Annually an ad valorem tax of not exceeding 112 mills may be levied upon all property in the county which.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. 1 Ad valorem taxes and non-ad valorem assessments shall be assessed against the lots within a platted residential subdivision and not upon the subdivision property as a. Clink the link to read more.

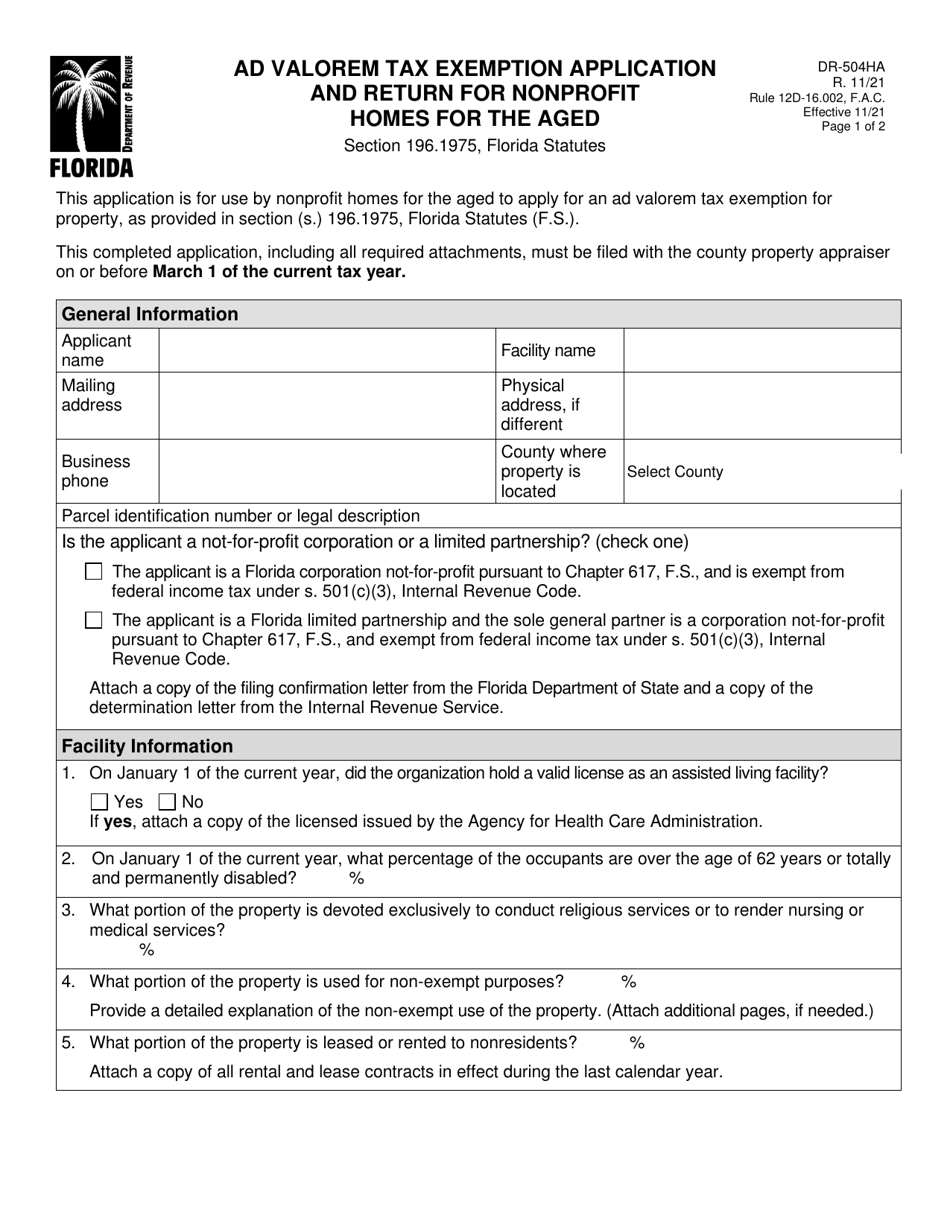

Section 1961975 Florida Statutes. An elected board shall have the power to levy and assess an ad valorem tax on all the taxable property in the district to construct operate and maintain assessable. To be filed with the Board of County Commissioners the governing boards of.

Millage may apply to a single levy of taxes or to the cumulative of all. Statutes Florida TitleXI Chapter125 PARTI 125_016 125016 Ad valorem tax. Florida Tax Law Blog.

Florida Administrative Code. Section 125016 Florida Statutes is a general grant to counties of the authority to impose an ad valorem tax and provides in full. The sovereign right of local.

Property tax can be one of the biggest. In addition the following definitions shall apply in the imposition of ad valorem taxes. HOMES FOR THE AGED.

ECONOMIC DEVELOPMENT AD VALOREM PROPERTY TAX EXEMPTION. Ad valorem ie according to value taxes are. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

1a Any real estate that is owned and used as a homestead by a veteran who was honorably discharged with a service-connected total and permanent disability and for whom a letter from. 10 Mill means one onethousandth of a - United States dollar. Florida Statutes 194301 Challenge to ad valorem tax assessment.

Based on the assessed value of property. An ad valorem tax levied. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendment.

The greater the value the higher the assessment. Floridas ad valorem statute allows tax exempt entities to be exempt from real property taxes when the property they own is being used to provide affordable rental housing. Rennert Vogel Mandler Rodriguez has one of the largest and most successful ad valorem taxation departments in Florida.

1 Ad valorem tax means a tax based upon the assessed value of property. Chapter 1961995 Florida Statutes. Ad valorem means based on value.

1 ad valorem taxes. This article discusses a Florida property tax exemption case involving the Alachua County chamber of commerce. 1 In any administrative or judicial action in which a taxpayer challenges an ad valorem tax assessment of value the.

In December 1999 the question of whether the city commission should be granted the authority to grant exemptions from city ad valorem taxes pursuant to Article VII section 3. Annually an ad valorem tax of not exceeding 1½ mills may. INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION.

Body authorized by law to impose ad valorem taxes. A lien against property. FL Stat 194301 2015 194301 Challenge to ad valorem tax assessment.

An elected board may levy and assess ad valorem taxes on all taxable property in the district to construct operate and maintain district facilities and services to pay the principal of and. SECTION SIX - AD VALOREMY TAXES IN FLORIDA There are several questions to be addressed in regard to ad valorem taxation in Florida. 194301 - Challenge to ad valorem tax assessment.

Florida Dept Of Revenue Property Tax Taxpayers Exemptions Filing Taxes Property Tax Revenue

Orlando Florida Squatter Laws Florida Law Florida Orlando Florida

Florida Revenue Floridarevenue Twitter Disaster Preparedness Preparedness Hurricane Prep

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged 2021 Templateroller

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Florida S State And Local Taxes Rank 48th For Fairness

Pin By J Elizabeth On 501 C 3 Charitable Organizations Guide Fl Tax App Charitable Organizations Organizing Guide

Florida Estate Tax Rules On Estate Inheritance Taxes

Pin By Claudia De Lillo On School Back To School Back To School Sales Holiday Items Back To School

Pin By J Elizabeth On 501 C 3 Charitable Organizations Guide Fl Charitable Organizations Public Information Organizing Guide

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Acceptance And Certification By Depository Probate State Of Florida Acceptance

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

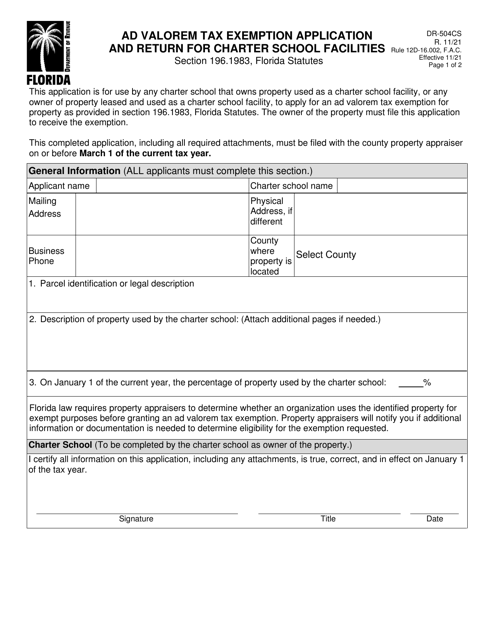

Form Dr 504cs Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Charter School Facilities Florida Templateroller

Overview Of The Rights Of Squatters In Texas Texas Being A Landlord Legal Services

Terms To Know Before You Start Your Home Search Real Estate Terms Home Buying Process Real Esate